17 search results - page 2 / 4 » Efficient Pricing of Barrier Options with the Variance-Gamma... |

SODA

2004

ACM

13 years 7 months ago

2004

ACM

Asian options are path-dependent derivatives. How to price them efficiently and accurately has been a longstanding research and practical problem. Asian options can be priced on t...

Book

This is a great draft book about stochastic calculus and finance. It covers large number of topics such as Introduction to Probability Theory, Conditional Expectation, Arbitrage Pr...

WSC

2001

13 years 7 months ago

2001

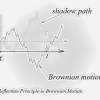

In this paper we present an algorithm for simulating functions of the minimum and terminal value for a random walk with Gaussian increments. These expectations arise in connection...

WSC

1998

13 years 7 months ago

1998

This paper compares Monte Carlo methods, lattice rules, and other low-discrepancy point sets on the problem of evaluating asian options. The combination of these methods with vari...

SIAMSC

2008

13 years 5 months ago

2008

Numerical methods are developed for pricing European and American options under Kou's jump-diffusion model which assumes the price of the underlying asset to behave like a ge...